Ah! well a-day! what evil looks

Had I from old and young!

Instead of the cross, the Albatross

About my neck was hung.

In Samuel Taylor Coleridge’s poem The Rime of the Ancient Mariner (1798), an albatross starts to follow the ship. Being followed by the large sea bird was seen as a sign of good luck. Then some idiot sailor shot the bird with his crossbow and everyone got mad at him because they ship started experiencing bad luck. As a punishment, they hung the bird around his neck for penance for his bad decision.

That’s where the saying “to have an albratross around the neck” comes from. Originally it was a punishment, but today has taken on the meaning to be more like a weigh or something holding you back. I think it’s a good metaphor for debt. Debt holds us back from building wealth and is a good reminder of past bad decisions we have made.

The first step to financial independence is getting out of debt. Debt is an obstacle that needs to be taken care of first before you can really start growing your wealth. Not only does it produce a drag on your growth, but it’s also stressful.

I know how stressful it is. I’ve been in debt of a couple hundred thousand dollars with little income to pay it back. I took out a few loans for a business and the business didn’t work. Btw, I would not recommend that (either the debt or the business failure).

Having to make payments to someone else and being fearful that if something happens, like you lose your job, you won’t be able to make those payments causes stress and anxiety for a lot of people. When I was deep in debt, I could wait for the weekends only because creditors wouldn’t call me on the weekends. I’d at least get a break for a couple of days. How sad is that?

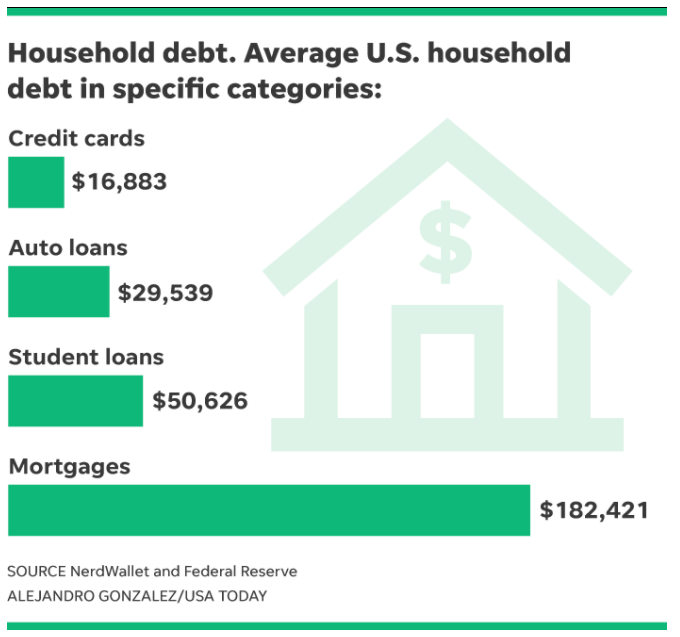

I wasn’t alone. In fact, I was pretty normal. Americans, and people the world over, have amassed a huge amount of personal debt. From credit cards to cars, houses, and student loans. The numbers just in the U.S. are in the trillions – $14 trillion total actually.1 Those big numbers don’t tell the real picture though. How much do families have? The answer: $137,063. Most of that is mortgages but includes credit cards, auto loans, and student loans.

Personal finance isn’t always about the numbers. It’s largely psychological. For example, it’s why people who don’t have discipline have lower returns than the stock market. They freak out and sell at the bottom or go in and out of the market and miss the big gains.

Personal finance isn’t always about the numbers. It’s largely psychological. For example, it’s why people who don’t have discipline have lower returns than the stock market. They freak out and sell at the bottom or go in and out of the market and miss the big gains.

The problem is, as my dad told me early in my career, it’s easy to get into debt, but much, much harder to get out.

It’s not easy to get out of debt, but it can be done. Being debt-free is an amazing feeling. The peace you feel from not owing anyone anything is worth the potential for some small arbitrage of having a mortgage or running up your credit card and paying it off every month. Simply put, you sleep better at night.

It’s not all emotional though. Once you’re out of debt, that frees up all the money you were making toward payments to go to investments. Your investments can grow even faster. Not to mention all the money you were paying in interest and late fees can now go directly into your brokerage account. It’s a snowball that gets larger and faster as it rolls down the hill. Wealth accumulates at an ever-faster rate as the accounts compound.

The first thing that must happen to get serious about getting out of debt is to change your mindset. Realize that you’ve got to change your lifestyle and make sacrifices. It won’t be easy. Most people aren’t willing to do that. They say, “you only live once” or “why not buy things now because you never know what the future holds” or they simply enjoy having a nice car or expensive clothes. They’re just not willing to do what it takes to get out of debt. That’s not us though. We’re smarter than that.

I used to be like that. I got out of debt in my 30’s, but got right back in. My wife and I were traveling the world and one day while relaxing in a hotel on the Black Sea we both realized we weren’t improving our financial situation. The debt we had was holding us back. That day we decided to make a change. It took 18 months of sacrifice and discipline, but we got completely out of debt.

For us, it was important to analyze how we got into debt in the first place so we could avoid repeating the same mistakes. Was it from credit cards? Online shopping? Not earning enough money? Taking a serious personal assessment of our past habits was difficult.

I confronted some realities that were uncomfortable. You don’t need to beat yourself up, but be self-aware and honest with yourself. Face your debt and your fears head-on. It may not be pleasant, but it will be helpful.

There are 2 main methods of paying off your debt. The first is called the Avalanche, which entails paying off the debt with the highest interest rate first, no matter the amount of the debt. The second method is the snowball method, which says to pay the debt with the smallest balance first, no matter the interest rate.

Mathematically the avalanche method will save you more money on interest, but the snowball method will give you more of an emotional boost because you can start closing out paid off accounts more quickly. Which is better? They both work, but if you’ve got any debt with very high interest, then go with the avalanche. Otherwise, go with the snowball because it’s much more likely you’ll stick with it because you’ll feel like you’re making a lot more progress. And as the numbers always prove, personal finance is largely about emotions. Small wins keep you motivated and on track.

Once you pay off the debts, close the accounts. People will tell you that it’s better for your credit if you leave them open, which is true. However, if they’re open you’re much more likely to just run up the debt again and be back in the same place. It’s much easier to not eat the chocolate cake at a restaurant if you don’t order it in the first place. Don’t tempt yourself.

The creditors try to make it seem like they’re helping you pay off your debt by offering things like 0% balance transfers or companies that offer debt consolidation loans. These may seem like they’re helpful but may end up costing you more money in the long run.

Introductory rates start out very low, like 0%, for a short time, but then after that period is over they skyrocket up to 20-30%! They get you hooked and then you’re back where you started, possibly with an even higher rate. You feel like you’re making progress but you’re just moving the debt around and are more likely to keep spending.

It’s the same with debt consolidation loans. The companies will give you a loan at a lower interest to pay off all your other loans so you then have just one big payment. Of course, they charge fees and interest for that, but one big drawback is you only have one payment.

Yes, I said it was a drawback. Not an advantage. One huge, intimidating payment. It’s a lot more fun to have smaller payments and payoff and close a credit card every few months. It gives you a real sense of progress. Seeing one big loan go down by tiny increments each month can be very demoralizing. Don’t underestimate the value of small victories to help you to keep going.

What about borrowing against your house or your 401k? This common question is similar to a balance transfer on a credit card. You’re not actually paying anything off. You’re just moving money around which may feel like progress, but it’s not. In addition, there are also penalties for taking money out of your 401k or IRA. It’s best to put money in those and forget about it until retirement age. I know if I had done that since my first job, I’d have a lot more money than I do now.

We all know that borrowing money has a cost. It’s called the interest rate. And don’t forget about all the fees. However, there are a lot of unseen costs that we don’t give as much thought to but are important to consider.

Several surveys over the past few years have shown than most people can’t come up with $1,000 in case of emergency. In one of the studies, 92% of respondents said they’d just borrow money in case of an emergency.2 A little planning and foresight can help anyone not need to go into debt to pay for unforeseen expenses. Having an attitude that debt will get you out of a pinch is a pretty good way to ensure you’ll get into debt.

If you have debt then you’re paying interest on that debt. That interest could be going to other places, like investments or vacations. That $10,000 credit card balance is costing you over $200 a month just in interest. That’s completely wasted money that you’re throwing out the window every month. With an average balance of nearly $17,000 and an interest rate of 19%, that’s $2,462 just of interest that Americans are wasting. That’s a nice trip to Europe (I calculate everything in the basic unit of “1 Trip to Europe.”)3

“What monthly payment can you afford?” is one of the questions that get people into trouble the most when buying anything, especially a car. What the salesperson is really asking is that they’d be happy to extend the term of the loan out long enough so the monthly payment drops. Of course, a longer term means more accrued interest to you. If you need a lower monthly payment then take out a smaller loan, don’t just extend it. If you can’t afford the payment without a longer loan, sorry man, you can’t afford it.

Paying off the debt sooner will save you money in interest charges. Another option is to make more frequent payments. Pay twice a month instead of once a month. That’s also a great way to pay off your house sooner and there are companies that will handle that for you if your mortgage company won’t. It may sound like a small thing, but it makes a huge difference over 15 or 30 years and won’t increase your monthly payment.

When saddled by debt, you have less freedom to do the things you want. You can’t take vacations or eat out as much. You’ve got a monster that needs to be fed. Having a lot of debt limits your options. It’s tougher to sell your house when you’re underwater or have a high loan to value (LTV). It’s more difficult to leave a job or take your time to find a job you love when you’ve got big payments and obligations to meet.

Your credit score may be lower if you carry more than 30% of the available balance. So if you’re credit card limit is $5,000 and your balance is $4,900, it’s not going to look good for your almighty FICO score.

Servicing debt each month means you’re not saving for retirement or other investments. The sooner you can put money into investments, the more time they have to earn interest and grow. As they say,

“There are 2 types of people: Those who earn interest and those who pay it.”

Money problems and difficulty talking about money are the leading causes of divorce. Many families have trouble paying their debts on 2 incomes. Then when they get divorced and a person has only 1 income, it leads to big troubles, stress and often bankruptcy. Bankruptcy has its own set of challenges and is something everyone should avoid at all costs. For example, there are some things like student loans, back taxes, and mortgage debt that can’t be forgiven in bankruptcy.

Make a list of all your debts, the monthly payments and interest rates of each debt.

Negotiate payoffs. Many lenders are willing to negotiate and even forgive some debt if you just call and ask. Sometimes they require you to pay off the debt all at once but are willing to give you a discount.

You can negotiate either a lower interest rate or a settlement amount. I’ve paid off 2 small loans in the past by just asking if they’d take a lower amount. For example, I owed $6,000 and I called and said, “I’d like to get this settled up. I know I’m a few months late in my payments, but I only have $4,000. I can either spread it around to my other bills or give it all to you if we can close out my account.” That’s really all I had at the moment. It worked both times I asked because they wanted my money right then.

Credit card companies are often willing to lower their interest rates, especially if you tell them that you’re going to do a balance transfer to another card if they don’t. They want to keep you as a customer. This works well with your cable company, cell phone provider and many others. T-mobile has been great about lowering my bill when I ask. You never know unless you ask.

Lastly, consider renegotiating your rent, if you don’t have a mortgage. When your lease ends, ask for a lower rent. It’s more expensive for a landlord to find a good tenant and if you’ve been good to work with and have paid on time, the landlord will likely be open to it. Often, if you sign a longer lease the landlord will give you a lower rate as well.

Stop using credit cards. Research shows that you spend more using credit cards (and even debit cards), so get some old fashioned cash out of the bank and use that instead.

Stop shopping online. Amazon pioneered the “1 click checkout” because they knew that the easier they made it for visitors to buy something, the more they will buy. It’s the same reason why Prime customers spend more on Amazon. Taking a break from shopping online will save you money and you’ll spend less impulse buying things you don’t really need.

Make it hard for yourself to spend money. Cancel subscriptions and stop going to the mall or bookstore “just to look.”

House, cars, and food are most people’s largest expenses. If you can make a dent in these major expenses, you make progress faster. To tackle these, you may have to make some major changes, like moving closer to work or getting a job closer to home to cut down on using your car or to get rid of a car. Downsize to a smaller house or apartment. Like I said, sometimes it’s not easy taking the required steps to get out of debt. People love their houses and cars and don’t want to give them up. Apparently, they like those possessions more than being out of debt.

It’s incredible that most people don’t have a budget or don’t even know where their money is going. When my family was getting out of debt, the 2 best things we did was to create a budget and to check our bank account every single morning.

I created a budget in Mint and tracked it every day. At the same time, I’d check the bank account every day. I knew where all the money was going, which makes it easier to stick to the budget and to cancel recurring subscriptions that we didn’t need anymore. I’d review any spending from the day before and ask myself, “Did I really need to buy that?” or “Do I really need that subscription?” The answer was usually “nope.”

It’s never fun logging into your bank account every morning only to see you’re broke, but facing the music, acknowledging your situation and knowing where all your money is going is worth the pain.

Or I’d see that we spent $100 going out a Friday night and be forced to think about what tradeoffs we were making by spending so much money. Before we had a budget and watched our spending every day, we didn’t realize how things add up. A night out can easily top $100 when you include dinner, a movie, gas, and a babysitter. Now since tracking things we know exactly how much things cost and where our money goes.

My wife is great at meal planning. Food is one of our largest expenses, so knowing how much everything costs at the grocery store is a big component of tracking where our money goes. Planning meals out each week not only ensure you’ll have more healthy meals, but it’ll also help save time and money shopping. Furthermore, you don’t have the stress of figuring out what to cook for dinner each night.

The most beneficial thing about weekly meal planning though, is you’re less likely to eat out. As I wrote in “Eating out is triple bad for you,” eating out is more expensive, less healthy and you end up eating more food, which makes you fat(ter).

In today’s modern world it’s easier than ever to go anywhere. Often it’s not too expensive. Cruises are a popular inexpensive vacation and even a trip to Paris isn’t out of the question for most people. If you’re in debt, however, you can’t afford it. Putting off the vacation while you pay off debt and saving up for it down the road will make the vacation much more rewarding later on. It’s so relaxing to be on a vacation knowing that it has already been budgeted and paid for rather than dreading the bills that are piling up each day you’re supposed to be relaxing.

Everyone has extra stuff they don’t need. In fact, the U.S. about 10% of people have storage units. We have so much extra crap that we rent places to put it. You can easily sell stuff on Craigslist.org or Facebook marketplaces and you’ll never miss it.

A simple way to pay off your credit cards and other debt is to just make extra or double payments. Making the minimum payment can take 10-15 years to pay it off in full. The last thing you want is to make payments for several years and at the end have the same or higher balance. That’s pretty discouraging. Making extra payments is also very satisfying and can give you a sense of progress while making actual progress at the same time.

Related: 5 common purchases making you poor

This one is true for everyone but especially true for business owners. We pay all our bills and then whatever is left over is what we keep. That’s how most people do it, which is backward. It’s backward because it doesn’t encourage savings because we end up increasing our level of spending to match our level of earnings. In his book “The Millionaire Next Door,” Thomas Stanley showed data that surprised everyone that high earners like lawyers and doctors have very low net worths because they spend it all before they have a chance to save it.

Make it easy on yourself and set up automatic deposits to your savings account and brokerage account first. Then use that money to pay off the debt in chunks. Otherwise, it’s too easy to just spend it all.

There are 2 sides to getting out of debt. Reducing spending or making more money. If you can do both at the same time, you’ll get out of debt even faster. Here are some ideas on how to make extra money.

There are a lot of reasons to start a business or do freelance work on the side. You get potential tax deductions on things like your supplies and home office, you can sharpen your skills or learn new skills or pursue a hobby and make more money to put toward your debts. The best part is that once the debt is paid off, you can put that money into savings or toward a vacation.

Asking your company for a promotion, pay raise or bonus may not be as crazy as it sounds. As they said in sales, you’ve got to ask for the sale. The worse they can say is no. Ok, maybe “hell no” is the worse they can say. Approach your boss and ask how you can make more money. As an employer, I can tell you that I’m very willing to work with employees who come to me with a plan on what they’ll do to earn more money.

Don’t just ask for it, but lay out a plan on how what you’re going to do will benefit the company, make the company more money or save the company money. Ask your boss, “If I do this plan that accomplishes X, can I get a pay raise or a bonus of Y.” Often that opens a discussion that can lead to some great things. Unless your boss is a terrible manager, he or she will appreciate the initiative and work with you.

My sister and her husband were both servers at a restaurant all during college. So was I. When she graduated, she was making so much more money as a server at a nice restaurant that she delayed getting a job in her field. I have a good friend who works during the winter as a ski guide and saves all his money so he doesn’t have to work during the summer. Every year around the holidays there are jobs available for extra help during the busy season (most retailers do most of their business during this time of year).

There are a lot of options like this, during every season, to pick up extra jobs to put all the earnings toward your debt. A lot of the jobs can actually be fun and adventurous.

If you’ve maxed out on what you can earn and your boss is unable or unwilling to work with you, then switch to a job that will pay you more. Consider a job closer to home that can cut out your commute and save you time and money.

Credit cards are a temptation most can’t avoid. As Dave Ramsey likes to point out, banks and credit card companies are some of the largest corporations on the planet. They spend billions of dollars to get people to use their cards. They offer rewards and points and make them easy to use. Against that kind of influence, the average consumer doesn’t stand a chance.

I know what you just said to yourself. You said, “But I’m above average. I always pay my credit card off in full every month.” That may be true. If so, you’re among the 39% of Americans who do. 4However, about 29% pay at or near the minimum payment.5.

The tricky part comes when you lose your job, get a pay cut or have an emergency expense. The credit card payment is the first thing to be cut out and the interest rates are often unforgiving. So it’s easy to go from the “always pay it off every month” category to the “making the minimum payment” category.

It’s becoming more and more common for companies to offer to finance for everything. Have you ever asked yourself why they do that? Is it for your convenience and well-being? Nope. It’s because they make a lot more money.

Back in the days when I was a financial planner, I had a client who owned a used car lot. He made a lot of money. Any guess how he made most of his money? It wasn’t from selling cars. It was for financing them at high interest rates.

Instead of financing things, save up for them. That does a few things. It helps exercise your discipline, which gives you more self-confidence. Once you buy whatever you’ve saved up for, you appreciate it more because you worked for it. Lastly, if you don’t really need it or want it bad enough, you’re not going to save up for it and won’t end up buying it. You’ll end up with a lot less useful stuff and can finally get rid of the storage unit full of useless crap and save yourself even more money.

Have a personal policy to not use debt for anything – a zero-tolerance policy for debt. Draw a line in the sand and stick to it no matter what. Just getting a little debt, like using a credit card, is a slippery slope. Don’t tempt yourself.

Not having an emergency is what gets people back in debt (or further in debt). The car breaks down or needs new tires. Your kid breaks his arm and you have a high deductible. Things happen. Having 6 months of cash set aside for emergencies really helps you to not be forced to put anything on the credit card. After all, you canceled that thing long ago, right?

Footnotes