Fear and greed drive the stock market. Or as famed investor Benjamin Graham noted, in the short-term the market is a voting machine, but in the long-term, it’s a weighing machine.

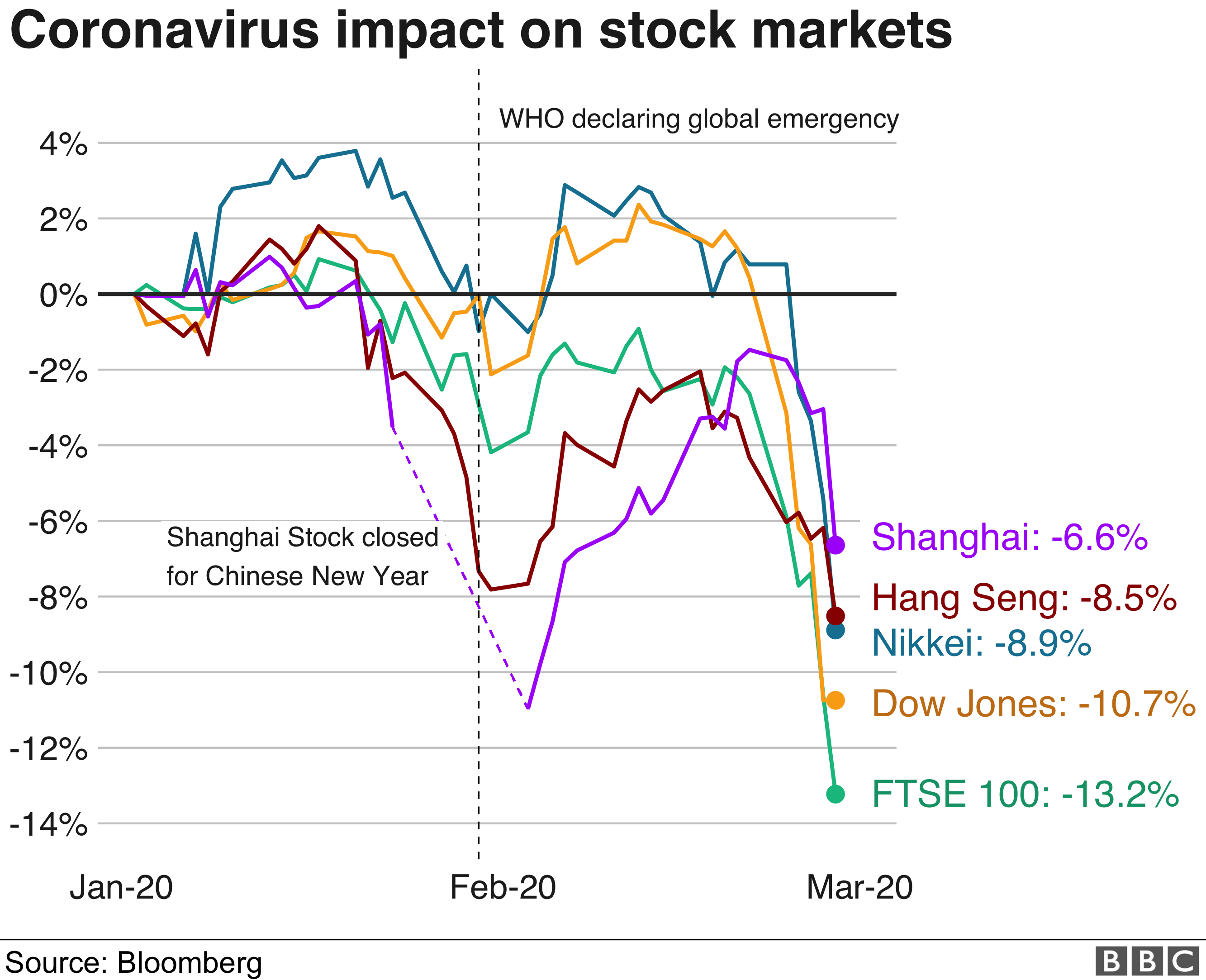

The past week most of the votes were to sell, which caused the market to tank by about 12% from their all-time highs just days before! It was the largest drop since 2008; giving up all the recent market gains from the past 6 months. All in just a week. Ouch! If you look at this chart, it’s pretty scary:

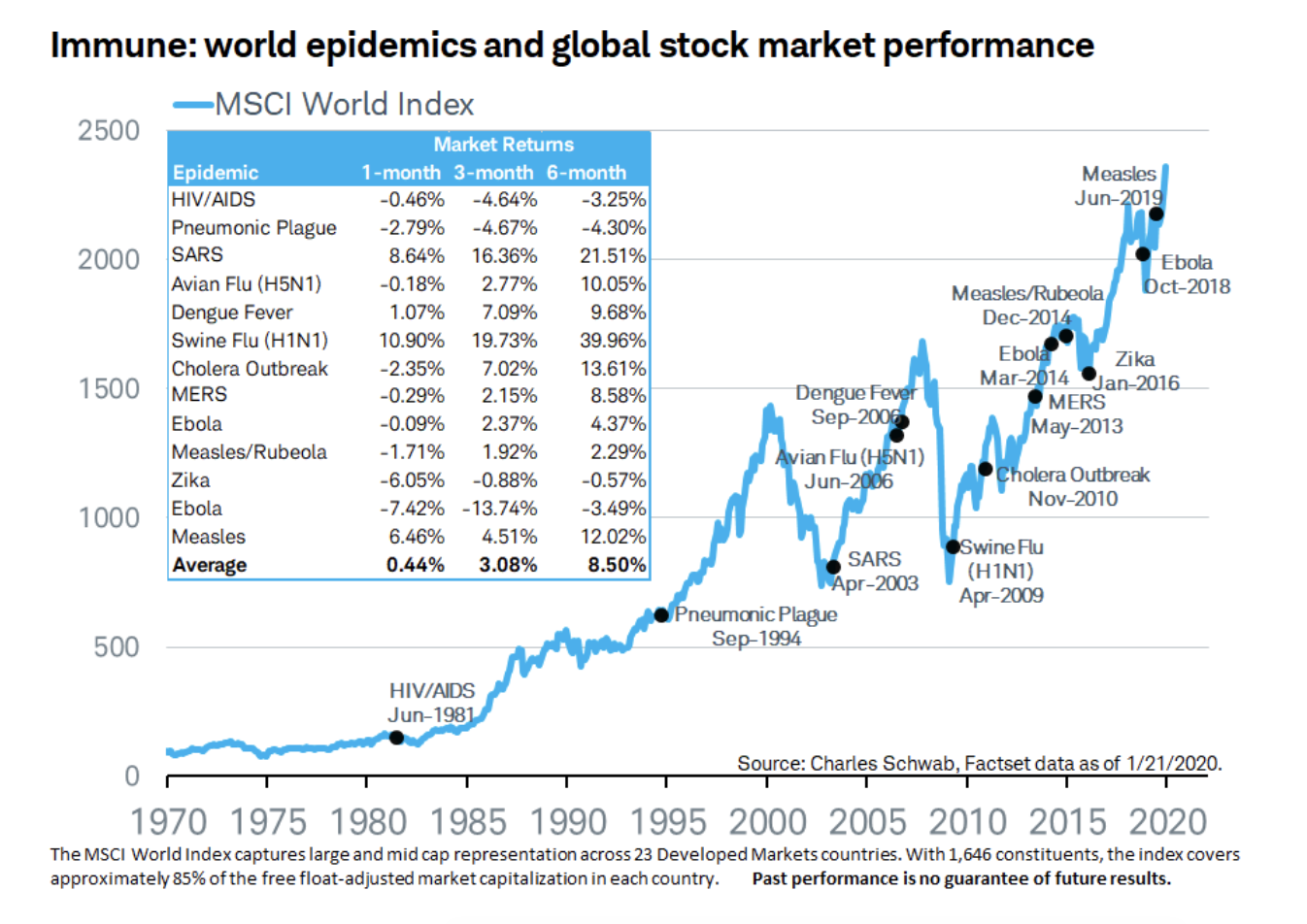

However, let’s take a step back and get some perspective. Let’s see how other epidemics have affected the market in the long run:

We can see from the chart above that past epidemics have had little to no long-term impact, even after a sharp drop. For example, in the 12 months after SARS, the market was up 21%. After the most recent epidemic, ZIKA, it was up 17%. 1

What the market hates most is uncertainty. The media and others play up the uncertainty to stoke fear for ratings. To be sure, epidemics and pandemics are serious and can’t be shrugged off. It’s not yet known how bad it will be, but we can be pretty confident it won’t be as bad as the media says because they always talk-up the worst-case scenarios.

One thing that’s different this time is that China makes up a larger portion of the world economy as it has in the past and companies have already been affected. But isn’t that always the story? This time it’s different? One thing I’ve learned from living through many dips, recessions, booms, and crashes is that it’s never different. It’s the same old story.

“The four most dangerous words in investing are: This time it’s different.” – Sir John Templeton

Shortly after the drop, Warren Buffett, Jim Cramer, and other investors said that it’s a buying opportunity. Why would they say that when the media is freaking out? Because they know markets have historically rebounded within a month after big drops like this due to past uncertainties. They are experienced enough to know to take a long-term view of performance.

When the market falls, I’m actually thrilled. I’m happy because it means I can buy stocks at a cheaper price and accumulate more shares. Since I’m in the accumulate phase of investing, I want to get as many shares as possible before they go up. For those in that phase who don’t need the money to live on and are putting money into investments, it benefits us to have a bear market for as long as possible, followed by a bull market just before retirement. Since it won’t work out perfectly, I’ll just be content when it goes down occasionally so I can get more shares and build a stronger position every month.

The price of a stock is based on the net present value of all future earnings. When investors think earnings will be high in the future, the stock goes up. When they think earnings will go down, the stock goes down. That’s a pretty simplistic view, but basically how it works.

The thing with sudden drops, which we experience periodically, is that it’s driven mostly by perception. Perception and forecasts that earnings will go down. Part of that perception is always based on fear. Fear and uncertainty that things will get worse.

In truth, earnings haven’t changed significantly in such a short period of time, but investors fear that they might. When stocks plunged thanks for the coronavirus, it was because investors feared it would disrupt the supply chain and cause companies to earn less money.

Pandemics can indeed change earnings and the coronavirus has undoubtedly affected earnings, but not by 12% in a few days. In fact, Apple closed it’s Chinese plants only to open them soon after. It may turn out the fear is unfounded. No one knows and so they sell. For the average investor, that’s a huge mistake.

If you have a plan, stick with it. As I said in the article on using financial advisors, most people lose money in the market because they get spooked when it goes down and sell. The investors who sold in 2008 are kicking themselves after witnessing the market rebound, followed by an 11-year bull market that has seen the market tripled in value.2

Whatever you do, don’t sell! Remember that you only lose money when you actually sell. Investors lose money over time due to emotional reactions, not because of the market. The market is pretty consistent, but our emotions are not. Our emotions can be more volatile than the actual market, so stay the course and stop watching the news.

Studies have shown that the best way to build wealth over time is to dollar-cost average. Meaning, to consistently invest whether the market goes up or down. It doesn’t make much of a difference over time if you try to buy at the bottom, like now, or sell at the top. Partly because it’s so difficult to know where the top or bottom is and partly because if you’re always buying consistently, it will even out.

As the old saying goes, time in the market is more important than timing the market.

The best thing you can do is to continue to max out your 401k and Roth IRA after all your consumer debt is paid off. Have contributions taken out of every paycheck and forget about it. Check back in 10 years and you’ll b pretty happy with what you see.

Check your asset allocation and make sure you’re comfortable with it. It helps to have non-correlated assets, like stocks and gold or even better, a job that brings income that’s not related to anything.

If you’re not comfortable with volatility or big drops, then consider diversifying into other asset classes like real estate.

Most of all remember that stocks fluctuate and there’s always another crisis around the corner. The financial talking heads on TV are always predicting the next crash. Eventually, they’ll be right because stocks always correct and then move higher.

Warren Buffett has said we’d all be better off if the price of stocks were only quoted once a year, rather than constantly, because the value of the underlying businesses change much slower than most people realize. It matters little how much stocks go up or down each day. Something that’s easy to forget when you lose 12% of your portfolio in a single week, but remembering to keep a long-term perspective will help us all sleep better at night. It’s why I feel at peace knowing that every week I’m buying a little bit more of the global economy as it chugs along to greater heights.

There’s only one Warren Buffett (and it ain’t you) or refer to the section on Financial Independence for all the articles.

The best way to stay on top of your investments, it to track them with Personal Capital. You can link all your accounts and get a full analysis of how you’re doing and the fees you’re paying. It’s like a beefier Mint.com but focused on investments. It’s free too, so that’s cool.

Footnotes