GET RESEARCHED-BASED TIPS ON HOW TO GET BETTER, FASTER.

[activecampaign form=79]

When the subject of investing comes up for discussion in social circles it’s usually the exciting stuff: day trading, crypto currencies, house flipping and technical analysis (reading charts). It’s the stuff that’s fun to talk about with friends. To trade stories about how you put money into Bitcoin and a week later sold it for double. Or how you found a stock that was about to break out or the chart that is showing a table top pattern and will break out any minute.

This stuff is fun to talk about, but is it really investing? By definition it is, but not the kind of investing that builds a solid, low-risk, low-cost portfolio. It’s not built on fundamentals you want to risk your retirement on.

The definition of investing is to “expend money with the expectation of achieving a profit or material result by putting it into financial schemes, shares, or property, or by using it to develop a commercial venture.”

So yeah, that can cover a lot of stuff. For now, let’s talk about some of the activities experienced investors don’t consider sound investments. That’s not to say you shouldn’t do them. Just recognize them for what they are: speculative.

I have some cryptocurrencies and it’s fun. But I recognize it’s more of a speculative hobby, not something I’m staking my family’s future on. Which is why money I have in crypto is limited to a very small portion of my portfolio. A portion so small that if I lose it all, it won’t bother me.

It was all the rage during the tech boom of the ’90’s. Day trading is the idea of making a lot of small trades on small stock movements in hopes that they all add up to profit.

I worked in tech in Silicon Valley during the boom and a lot of my friends were into Day Trading. However, I never met anyone who actually made money in the long run and none of them is still doing it.

I’m sure you’re seen the advertisements for trading sites telling you how easy it is. You can trade stocks, Bitcoin, futures or options or anything else. They’ll help you do it. For a fee.

The major problem is that no one makes money. It takes a lot of time to learn how to do it, so it’s a big time commitment. So if you’re not a professional trader, it may not be worth your time.

You’re competing against large, institutional traders who have super fast systems, years of experience and a lot of money to risk that isn’t theirs.

A 2011 study of day traders showed than only about 1% of all traders were able to profit consistently after fees. 1 If you’re really good and have a mentor, the chances of success can be as high as 4.5%, according to this interesting account by a former trader. Those aren’t very good odds. You’re better off betting all your money on black.

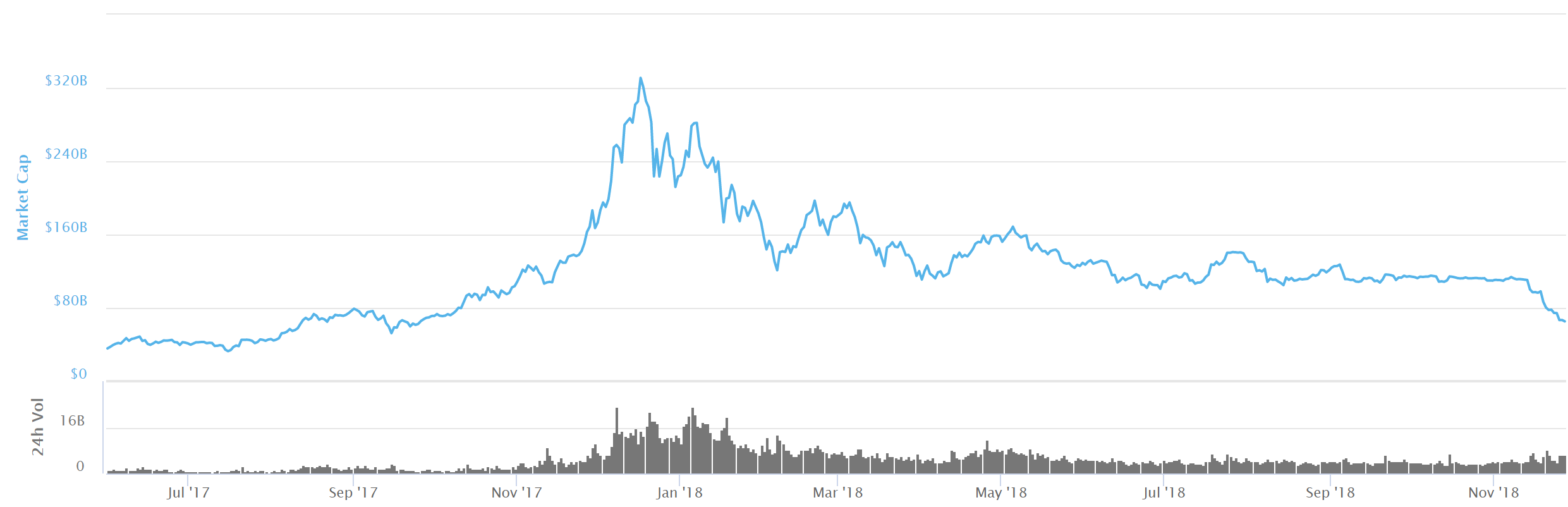

Anyone could make money in crypto in 2017. Until they couldn’t. It only went up and like all bull markets, everyone thought it was easy. Until everything crashed and Bitcoin was trading 85% off its high.

Joe Kennedy, a rich investor in the 1920’s said he sold his stocks before the Great Recession after his shoe shine boy offered him a stock tip. He figured if even the shoe shine boys think they’re experts in the market, then the bull run was over. He was right.

I knew it was a top of the crypto market when I heard everyone in the office talking about investing. It was the same thing in 2000. Everyone was an expert. When everyone is talking about it is not the time to buy. Or as Baron Rothschild, of the Rothschild banking family said, “the time to buy is when there’s blood in the streets.” Yikes!

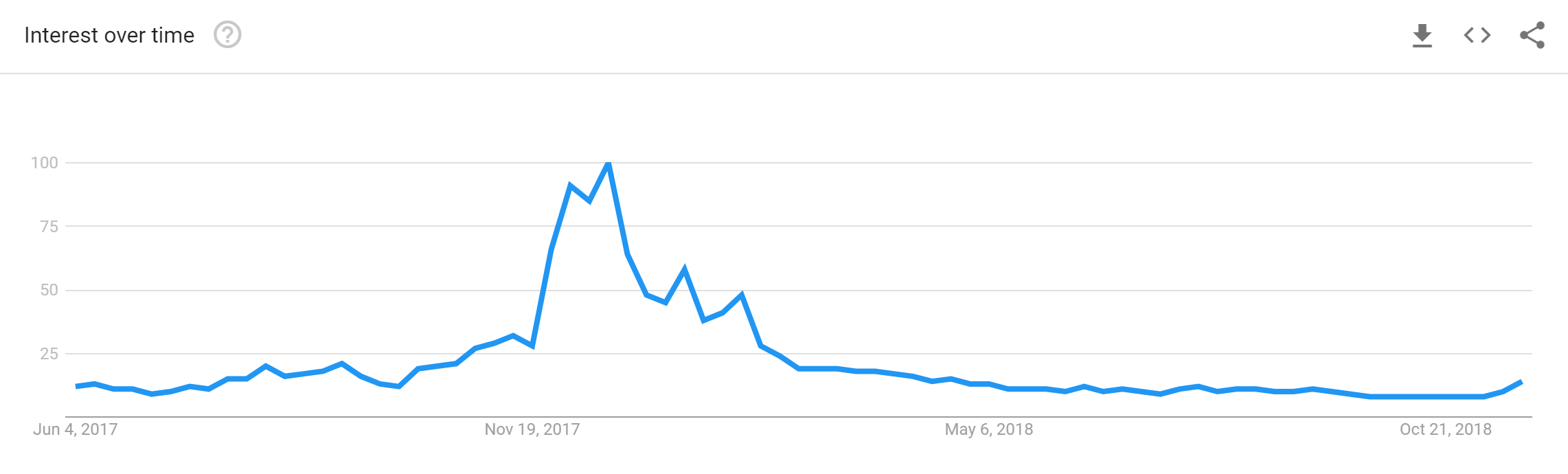

It’s interesting to overlay a chart of the price of Bitcoin with Google Trends to see how correlated they are. The people who make money are either the contrarians or the ones who ride the wave and sell at the high point, which is near impossible unless you have an amazing fortune-teller. Everyone likes to talk when things appear easy. No one talks about safe, consistent investing because it’s boring and no one talks about their losses.

Ever since my college finance classes, I’ve been bewildered why people put any confidence in technical analysis. When analyzing stocks there are two different methods: technical analysis and fundamental analysis. Fundamental analysis is the kind Warren Buffett does. You may have heard of this guy. He’s widely considered to be the best investor of all time. Not to mention one of the world’s richest people. Most successful investors investors do fundamental analysis.

You may even say real estate developers, business owners and anyone who analyzes a business based on fundamentals like revenue, profit and cash flow, are basing their decisions on fundamental analysis. It’s what sound investing is built on.

On the other hand, there’s technical analysis, which by some is considered akin to tarot card reading. This kind of analysis focuses on reading the charts and trying to predict what the market will do based on what it’s done in the recent past. This method is not taken seriously most investors.

In fact, all the big time investors, from Buffett to Peter Lynch use fundamental analysis. In 2008 New Zealand’s Massey University published a study looking at 5,000 different technical analysis strategies and concluded that NONE of them produced results better than throwing the dice.2

That’s all I’ll say about technical analysis for now. Email me if you’d like me to write more about it or comment below if you have an opinion on whether or not it’s useful. (Hint: it’s not!)

The last type of investment to stay away from is any hot tip from ‘smart people.” You know how it goes. A friend tells you about this deal his friend is involved in. It’s a company that makes a new juice or gadget or whatever and it’s going to change the world. Now is the time to get in on the ground floor. You’ll make millions. Everyone’s eyes are big and they’re excited about how much money they’re going to make. Until they lose it all.

It’s this excitement and euphoria which leads people to put aside their fundamental analysis and common sense and invest anyway. This happens with crypto, real estate, business deals or any other category. It’s the investment that’s too good to pass up. The one that must be done NOW! It’s the one that’s going to set you for life, but you’ve got to act fast.

There do, in fact, exist deals that are amazing, but consider the risk. Think about Warren Buffett’s #1 rule of investing: Never lose money. If you’re building a portfolio and you lose all or a big chunk of your money, say 50%, you need to make a 100% return just to get your money back. How hard is that? Pretty tough. One bad decision could take 7-10 years to come back from. Maybe that’s why Buffett doesn’t do it and why he’s one of the most successful investors ever. Hey, but if you’re smarter than him, go for it. (Hint: there’s only one Warren Buffett and it ain’t you)

So if all these popular investments aren’t worth your time, then what is? It turns out something far less glamorous and much more boring: Investing consistently in low-cost Index Funds, which we’ll cover in the next article.

What do you think? Have you invested in any of these and done well or lost your shirt? Share your thoughts below.

To read the entire Investment & Financial Independence Series, start here.

Get on the newsletter email list to be notified when the next post in the Investment Series is live.

[activecampaign form=79]

Footnotes