In a hot and dusty suburb of Recife, Brazil in 1994 I shopped for my weekly groceries. I stood amazed looking at the entire isle of just beans and rice. Every trip to the local grocery store continued to amaze me at how much beans and rice Brazilians eat. It was stacked up on palettes. Lots of them. Not even modern-day Costco has piles of products the way Brazilian stores have beans and rice.

I wasn’t there to marvel at the food. I was there buying my weekly groceries. I had just come from the bank where I withdrew my bi-weekly paycheck. It had arrived minutes before I withdrew it and immediately went to the store and spent nearly all of it. I saved just enough for bus tickets for the next 2 weeks. Everything else I spent. I had no other choice.

I normally don’t like spending all my income immediately, but these were different times. Inflationary times.

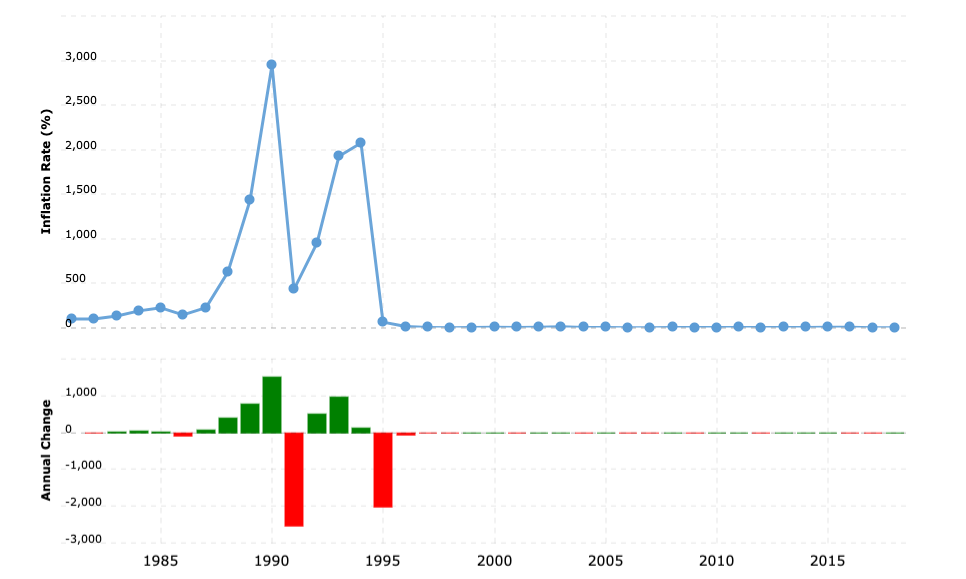

If I didn’t spend that money immediately it would be worth less tomorrow. In fact, in 1994 the annual inflation rate was 2,075%, down from a high in 1990 of 2,947.93 1

To put that in perspective, the U.S. inflation rate has hovered around 3% since the early ’90s, which is seen as a health rate. However, the U.S. has had some inflationary times recently. We’ve all heard our parents talk about how crazy inflation was in the ’70s. It peaked at 13.55% in 1980.2

To put that in perspective, the U.S. inflation rate has hovered around 3% since the early ’90s, which is seen as a health rate. However, the U.S. has had some inflationary times recently. We’ve all heard our parents talk about how crazy inflation was in the ’70s. It peaked at 13.55% in 1980.2

For a few years, every time anyone went to the grocery store (or to buy anything else), the prices were double what they were the week before. Inflation got so bad that stores couldn’t keep up with repricing everything and changing all the tags so they developed a number system. Your item may have a tag on it that said “47” and shoppers would then look at a Rosetta Stone list that gave a price for each number. The number 47 would equal $4.99, for example. Every day the store would update the list instead of retagging everything.

That’s some serious inflation. The worse inflation the U.S. has had in modern times was in 1918 of just over 20%. 3 A lot of crazy happened that year – World War I and the Spanish Flu, so high inflation isn’t surprising.

So far the expected inflation rate for the early 2020’s is only 1.43 4, but if history is any indication, things can change quickly. It’s important that we’re prepared.

Hungary holds the record for the highest inflation. “On 1 January 1946, one adópengő equaled one pengő, but by late July, one adópengő equaled 2,000,000,000,000,000,000,000 or 2×1021 (2 sextillion) pengő.”5 It’s interesting to note, however, that this insane inflation rate was done on purpose to restore the economy after the war.

That’s a pretty quick change. The scary part is that these sudden jumps in inflation happen all over the world. Recently it’s happened in Zimbabwe (2007-2008) and Venezuela (2014 to present). In Zimbabwe, it only took 24.7 hours for prices to double. Yeah, that’s hours, not days or years.6 The IMF estimates that inflation in Venezuela in 2019 would be about 200,000%. That means your income and buying power is pretty much shot to hell.

Inflation is a measurement of the speed of price appreciation of a basket of goods over a specific period of time. It’s the spending power of a currency. Often called a quantitative measure, as opposed to qualitative, because it deals with the amount of a currency.

As we’ve seen in Brazil, Zimbabwe, and other countries in both the past and present, there is a risk that our buying power and portfolio will be eroded. It’s one of the reasons why most people don’t keep large sums of money in their bank accounts. Or at least they haven’t for the past 10 years while interest rates have been super low and bank savings accounts pay practically nothing.

If a savings account pays 0.1% interest and inflation is 3.1%, then each year your money is actually worth 3% less. You’re going in the wrong direction.

It is important to know what causes inflation so you can understand how to control inflation. We’ll later highlight ways of solving inflation, for now let’s concentrate on inflation causes.

An increase in demand for products, at either the consumer level or production level, can cause inflation to increase. At the production level, prices of labor or raw materials may increase and drive up prices of the end goods.

One of the most common causes of inflation is when a central bank prints too much money. It was a common concern in 2007-2008 with the Quantitative Easing (QE) program which was designed to fight against deflation. If it worked too well, then inflation could result.

Those concerns have resurfaced with the QE associated with Covid-19. QE is used when interest rates are low so central banks can’t use the usual monetary policy measures.

During the Great Recession, the Federal Reserve put lots of money into the money supply, so why didn’t that lead to inflation?

QE from the Great Recession didn’t lead to inflation because the U.S. already had some deflation. Secondly, as money went into the system, banks kept the money to strengthen their balance sheets instead of lending it. I recall during those times it was very difficult to get loans as banks tightened their regulations to help them recover from the drop in the housing market.

Related to printing too much money, is fiscal responsibility. Some countries like Hungary after WWII have used the printing and spending of money to their advantage, but other countries have been reckless with both and as a result, have had a tough time keeping inflation rates down.

This is what happened in Zimbabwe. The country started spending to make citizens happy but wasn’t in a position to raise taxes or they’d be out of office. There had already been protests against raising taxes. To curb inflation the country got rid of its currency and started using foreign currency. Not something any country wants to do, especially the United States. Losing the power that comes with being the world’s reserve currency would have serious repercussions.

Inflation can often be a manifestation of underlying societal and political problems. If inflation is creeping up and rising dramatically, there’s usually more going on than just printing too much money. The central banks are trying to solve large and complex problems, often problems that have been building for some time. As we’ve seen with Zimbabwe, inflation was partially caused by the government trying to appease its citizens and tamper down the social unrest.

Now that you know the causes of inflation, let’s talk about some measures to control it:

Inflation is not so great for consumers since their buying power goes down as inflation goes up, which is why central banks work to keep inflation rates down.

For companies, however, it can be much less damaging since prices are increasing. As an investor who may own a small piece of that company in the form of stocks, it’s a good hedge against inflation since companies can pass the effects of inflation on to consumers.

However, not all stocks are equally equipped to hedge. Look for stocks that can pass the increased costs on to consumers. It’s debatable whether high-dividend paying stocks are good or bad during inflation, so keep a diverse portfolio.7,8

Owning property as a landlord or in a REIT can be a great hedge against inflation for 2 reasons: first, real estate produces cash flow and landlords are usually able to increase rents to keep pace with inflation. Second, the value of the property will increase along with inflation as prices of other things rise.

As inflation increases, people lose confidence in the underlying currency so they’ll look for other options. One may be to buy other currencies, like the dollar, as people did in Brazil when I was there in 1994. The dollar became very powerful and I could buy a lot more for my dollar because it was stable. People wanted to have dollars under their mattresses because they’d be worth about the same a month or year later.

The top commodity is probably gold. It’s been popular for centuries as a store of value and people still to this day buy gold as an inflation hedge. Other commodities include cotton, soybeans, orange juice, and oil. The price of these commodities all rise with inflation since societies and economies need them to run.

Usually, bonds are exactly what you don’t want to buy in inflationary times, but there’s an exception. Inflation-indexed bonds called TIPS (Treasury Inflation-protected Securities), which are pegged to the inflation rate. As the rate goes up, so does the bond – both the base value and the interest.

Any portfolio should have a proper asset allocation, which is reviewed frequently to ensure it matches your risk tolerance, objectives, and time horizon. If you’re worried about inflation, it doesn’t make sense to put everything in TIPS just to ease your nerves, for example. The chances of runaway inflation are slim, but putting everything into one asset class could ensure that your portfolio underperforms.

Also, if you’re in your ’20s or ’30s, you have a lot of time to just let it ride and do nothing. A solid portfolio will help hedge against future fluctuations and changes in the economy.

Next, we’ll look at the other side of the coin – deflation. What the causes are and how you can protect yourself.

VTSAX, the case for investing in low-cost index funds

Footnotes