We talked about moving to Puerto Rico in one of our previous blogs. However, it’s not the only country for expats. In this article, we’ll talk about living in China as a foreigner and the financial challenges you may have to face living there.

Despite its huge population, China openly welcomes expats including native English speakers to teach English to the growing Chinese population. There is no dearth of jobs in the country.

There are more than 600,000 expats working in the country and the number is expected to increase in the future with more international companies finding a foothold in China.

While there are many benefits of working and living in China as a foreigner, it does come with some challenges.

Having to settle in a new environment and get used to a different taste in food are not the only issues expats have to face. They also have to handle financial challenges that can make it difficult to manage funds.

In this article, we’ll look at some of the main financial challenges of working and living in China as a foreigner while also highlighting some reliable solutions.

Let’s start:

A lot of people who move abroad to work have to worry about family back home.

It isn’t uncommon for workers to send remittances to their friends and loved ones. This might sound simple on paper but sending or receiving money to and from China can be troublesome since a lot of international money exchanges or platforms are not available in the country.

China doesn’t look at cryptos in a very positive light, which means you will not have the option to use blockchain-based providers to send or receive money.

PayPal covered the market in a major way last year when it acquired a Chinese licensed payment company known as GoPay. You can use it to send money to your country.

Other options include Western Union and bank transfers but the latter requires paperwork and can be slow and costly.

Moving out of China with money for any reason can be a little difficult as individuals exiting the country are required to declare sums if they’re carrying more than RMB 20,000 (USD 5,000). This is also the maximum amount you can leave the country with.

If you wish to leave the country, you will have to use other methods to send your savings abroad.

It can be difficult to meet sudden financial needs in the country as there are limits on how much money a foreigner can withdraw at any given time without providing records of taxes, proof of ownership, and other documentation.

This amount stands at $500. Gathering all the required documents and getting your application approved can take quite some time.

To solve this problem, we suggest that you have all the documents that you may need.

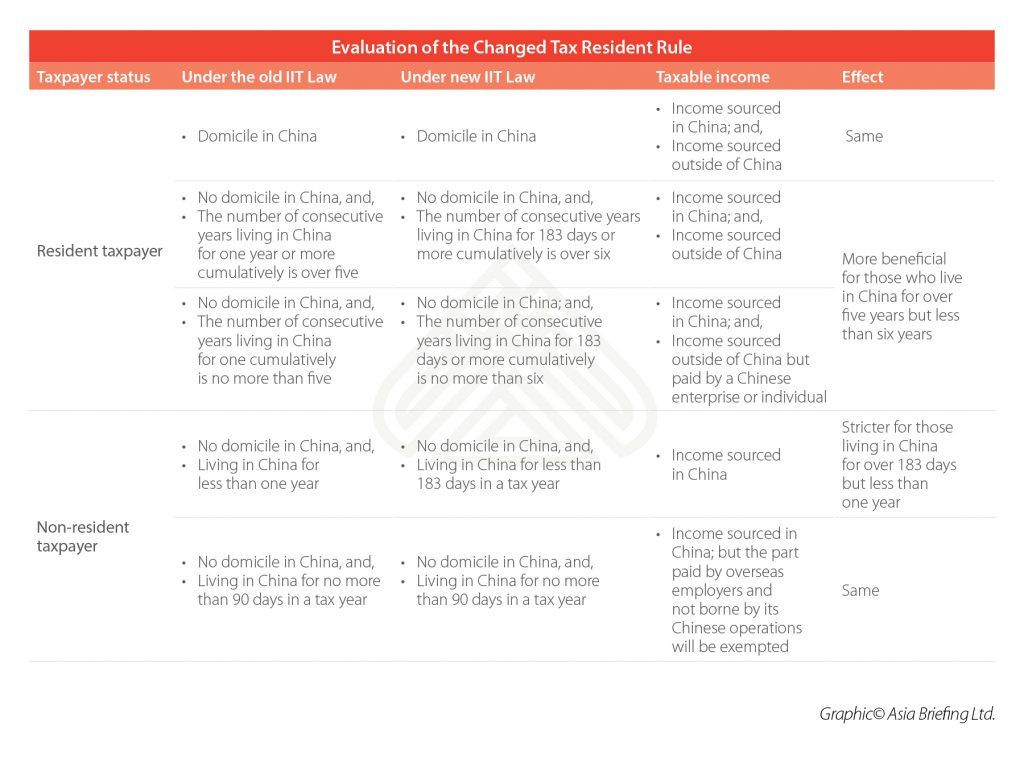

Expats have to worry about taxes when they’re living in China. Foreign nationals are only taxed on the money they earn from a Chinese source. However, you will have to pay taxes on your worldwide income if you’ve been living in the country for more than five years. This can make it very expensive, especially if you have to pay taxes in your home country as well.

It’s best that you speak to a lawyer about the best way to save tax money.

The individual income tax (IIT) law in China that came into effect in 2020 also leaves some questions. The image above highlights the changes.

This might come as a surprise to some but expats do not have as many investment options in China as they may have in their home country. Let’s talk about the United States, which is home to some of the largest companies in the world.

Unfortunately, most US firms are not listed on Chinese stock exchanges, which means you may not have the option to invest in them. Plus, China hasn’t fully opened its financial markets to foreigners. According to a CNBC report, the country is working on making some changes but it’s a long road ahead.

Expats can own property in China but such investments come with some very stringent prerequisites. For example, you can only own one property in the country and it must be residential. Moreover, there are requirements by the location, i.e.: you might not be able to buy a home in specific cities.

To solve this problem, consider working with online brokerages that cater to international investors.

It is mandatory for everyone in the country to contribute to China’s social security system. The rate totals just over 10 percent; however, it does come with some valuable benefits including medical insurance, maternity insurance, and work injury insurance.

Make sure to know about all deductibles so that you aren’t surprised.

Finding a job in China isn’t as hard as it seems. You can teach in China or look for other jobs.

You might have to face some challenges at your new job, such as a high cost of living, in the beginning but settling in this unique country is a lot easier now than it used to be.